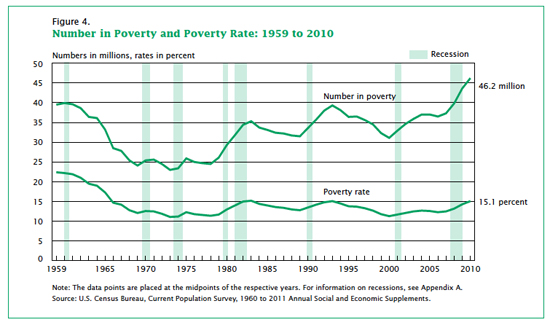

For some time now, the struggling U.S. economy has dominated headlines and shaped conversation among Americans. New data released Tuesday in a report from the U.S. Census Bureau, “Income, Poverty, and Health Insurance Coverage in the United States,” paints an even starker picture of the challenges our nation faces:

- The U.S. poverty rate rose to 15.1% in 2010 — up from 14.3% in 2009 and to its highest level since 1993.

- About 46.2 million people are now considered in poverty — 2.6 million more than last year. That’s nearly 1 in 6 people.

- More Americans were living in poverty in 2010 than at any time since at least the 1950s.

- The situation has hit black populations the hardest, with their poverty rate rising from 25.8% to 27.4%.

- Meanwhile, child poverty rose from 20.7% to 22%.

- Having a job is not a guarantee against falling into poverty. The poverty rate among all American workers was 7% — and 15% among those working part-time.

Research shows that poverty is the single greatest threat to child well-being. It can impede children’s ability to learn and contribute to social, emotional, and behavioral problems. Poverty also can contribute to poor physical and mental health. Risks are greatest for children who experience poverty when they are young, and those who experience deep and persistent poverty. (Source: National Center for Children in Poverty)

Moreover, the recession’s impact on children is reaching new lows. According to the 2010 Child Well-Being Index from the Foundation for Child Development, the recession has wiped out virtually all progress made for child well-being since 1975.

The federal poverty level is an income of $22,314 or less for a family of four. That often makes school supplies an inaccessible luxury for parents who can barely afford rent and groceries. By providing donated backpacks filled with school supplies to some 25,000 U.S. students, World Vision helps reduce the burden on struggling families and makes it easier for children to stay in school and learn.

We also work to equip schools in America’s cities, while offering programs that promote leadership and empowerment among vulnerable youth.

In this ongoing economic downturn, children from struggling families are placed at greatest risk. Which raises the question: How will America respond to spare them from its worst consequences?

Comments